Relevant Life Cover

Most group risk providers are reluctant to write schemes for fewer than 5 members, and then only as part of a registered group risk scheme.

Our approach is different. The relevant life policy is a single life, stand-alone death-in-service plan, providing benefits on an individual basis.

Key benefits :

– Unique individual stand-alone cover

– Tax advantages for high earners

– Premiums not taxed as a benefit in kind

– Allowable as an expense for the employer

– Cover now up to 20 times annual salary

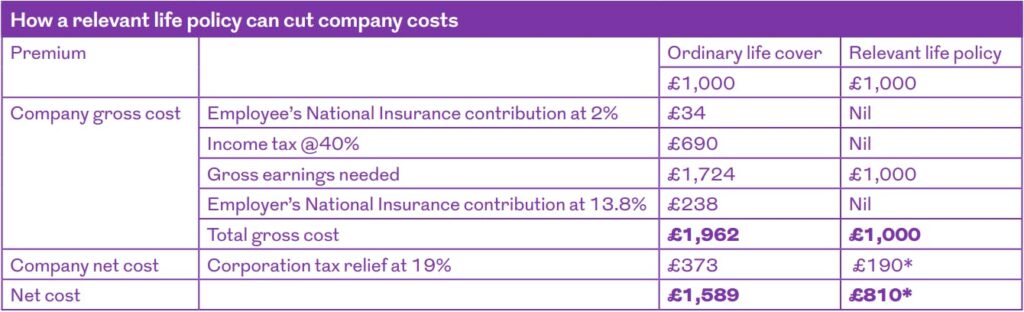

There are various advantages to this. For a start, it offers high-earning employees who have substantial pension funds a number of tax advantages.

That’s because the lump sum benefits do not form part of the employee’s annual or lifetime pension allowance.

And, although the company pays the premiums, they are not normally taxed as a benefit in kind – which can offer huge savings, especially for a higher rate taxpayer.

While it is mainly aimed at high earners, it can be suitable for any employee. What’s more, the payments may also be treated as an allowable expense for the employer in calculating their tax liability.

Which means it is also particularly suitable for small businesses that do not have enough eligible employees to warrant a group life scheme.

Who can have it

An employer’s business which is UK registered, and the employee who is habitually resident in the UK (meaning England, Wales, Scotland, Northern Ireland but not the Isle of Man or the Channel Islands).

Has a UK bank account and is not:

* Under 18

* 74 or older (cover stops at age 75).

The employer will own the policy and the employee will be the person covered but as Relevant Life Cover is written in trust, for the employee’s beneficiaries, the pay-out will go into the trust in the event of a claim.

Table Source : Royal London Marketing Studio

Now that looks like a head start for your business.

Remember, this is based on our understanding of current tax law which could change in the future

The Plan will have no cash in value at any time, and will cease at the end of the term. If premiums are not maintained, then the cover will lapse.

Send Us an Enquiry

These are external links to our social media accounts , by clicking on any link you will be taken away from the regulated website

Group medical Cover

Health Insurance is designed to cover the cost of private medical treatment for medical conditions you may suffer in the future – this can be something simple like breaking a bone or more serious like a heart attack

Read More....

Cross Option Agreements

The death of a shareholder who is also a director can have a major impact on any business if the company has not made plans for such an event.

Read More....

Keyman Insurance

When you’re just starting out, you’ve got a lot on your plate, and it seems like you spend all your time working on the urgent stuff–trying to get your product or service ready.

Read More....

Shareholder Protection

Shareholder protection insurance also helps other shareholders settle any future problems say for instance the death of one of the shareholders or when a holder gets a serious illness..

Read More....

Business Protection

This website is only directed at persons within the UK.

Anthony Marshall trading As Marshall Financial Solutions is an appointed representative of The On-Line Partnership Limited which is authorised and regulated by the Financial Conduct Authority

Copyright © Marshall Financial Solutions 2019. All right reserved. | E-Mail: Info@marshallfinancialsolutions.co.uk